This is one of the most commonly asked questions by those of you who are thinking about moving to the Charleston Metro Area, or those of you who are moving from a rental in Charleston to your very first home! Not only are you seeing all kinds of numbers that don’t make sense online, but also you are hearing things like “it’s 4% or 6%”, and take that to mean for a $500,000 home you’d be paying $20,000 or $30,000 annually. Right?? Not so. Not even close.

So let me shed some light on what you will pay in property taxes in Charleston County:

- First thing to remember – the taxes you see online, or what someone currently pays, have absolutely NOTHING to do with what you will actually pay. 🙂 When you buy a house in Charleston, the taxes are then recalculated based on the sales price, and whether or not you are using it as a primary or secondary/investment home. Keep in mind taxes are paid in arrears here, so when you buy that house, you actually get a credit from the seller on the closing statement, because you’ll be paying the full bill when it comes due at the end of the year.

- Second thing to remember – Charleston County property taxes for primary home owners are some of the lowest in the country. For second home/investment properties – not so. As matter of fact they are almost triple the primary home rate.

- Third thing to remember – Bookmark this link. It’s the Charleston County Tax Estimator.

On to our examples

Primary Home

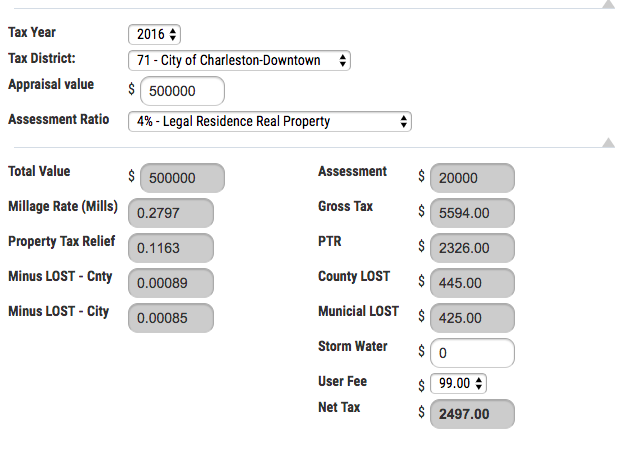

If the home you buy in Charleston is your primary home, you benefit from a 4% tax rate, as long as you meet all the criteria for the 4% (application here). So what will you pay?? First, take the sales price, multiply it by 4%, then multiply that by the millage rate (.2676 Downtown) and you have your base rate. But then there are tax credits as well!

So rather than trying to figure it out on our own, let’s go back to the tax calculator. Here’s a screenshot for a $500,000 primary home in Downtown Charleston (other areas are slightly less expensive).

You will pay approximately $2582 annually!

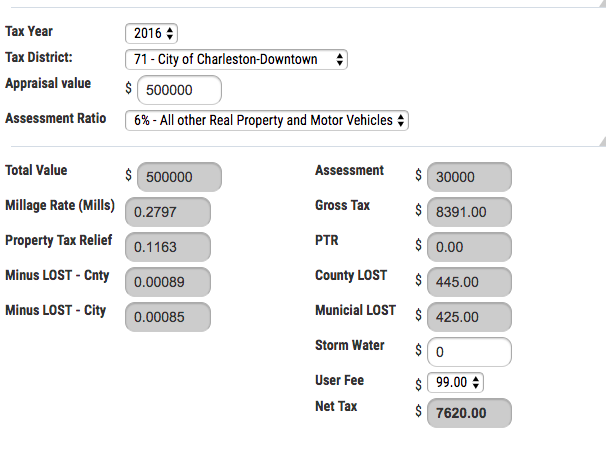

Second/Vacation Home or Investment Property

The second home or investment property rate is higher at 6%, and you don’t benefit from the deductions. So to estimate your taxes on your great ‘other’ place, take the sales price, multiplied by 6%, multiplied by the millage rate (.2676 Downtown) etc…etc… So here’s that same $500,000 home that you are using for a second home or a rental property.

You will pay approximately $7272 annually! Now that’s a big difference isn’t it?

So, you won’t pay that same amount forever. Every few years the tax assessor comes out to reevaluate your property and the market, and your taxes will either go up a little or down a little depending on what they find. And there are limits to how much they can go up over time, but that’s a discussion for another day…

So, I hope that helps! Of course, if you have any more detailed questions, please consult a tax accountant or attorney. 😉